Services performed but unbilled total 0 – With services performed but unbilled totaling $600, businesses must navigate the complexities of accounting treatment, financial statement implications, and efficient management strategies. This comprehensive guide delves into the nuances of unbilled services, empowering businesses to optimize their revenue recognition processes and maintain financial integrity.

Unbilled services arise when a business has completed services for a client but has yet to invoice or receive payment. Understanding the proper accounting treatment, impact on financial statements, and effective tracking methods is crucial for accurate financial reporting and informed decision-making.

Services Performed but Unbilled: Services Performed But Unbilled Total 0

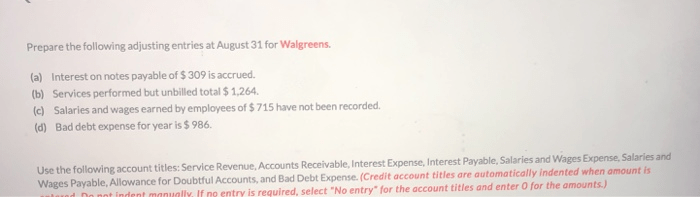

Services performed but unbilled (SPBU) refer to services that have been provided to customers but not yet billed or recorded as revenue. This occurs when a company completes a service before issuing an invoice or receiving payment. SPBU represents earned income that has not yet been recognized on the company’s financial statements.Accounting

treatment for SPBU requires recording the services as accounts receivable and deferred revenue. Accounts receivable reflects the amount owed by customers for the services rendered, while deferred revenue represents the unearned portion of the revenue that will be recognized when the services are billed and paid for.

Impact on Financial Statements

SPBU has a significant impact on financial statements: Balance Sheet:SPBU increases both accounts receivable and deferred revenue, which can inflate the company’s current assets and liabilities. Income Statement:SPBU does not affect current revenue but increases future revenue when the services are billed and recognized as income.

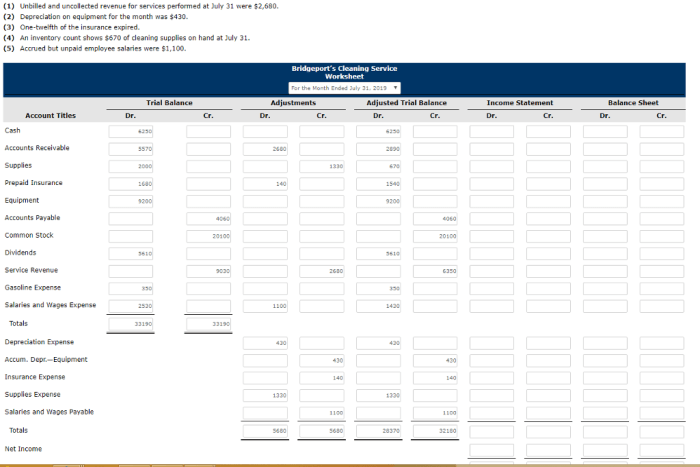

Methods for Tracking Unbilled Services, Services performed but unbilled total 0

Various methods can be used to track SPBU:

1. Manual Tracking

Using spreadsheets or physical ledgers to record unbilled services and update them manually.

2. Software Solutions

Employing accounting software that automates the tracking and management of SPBU.

3. Project Management Systems

Utilizing project management tools to track the progress of services and generate unbilled invoices.

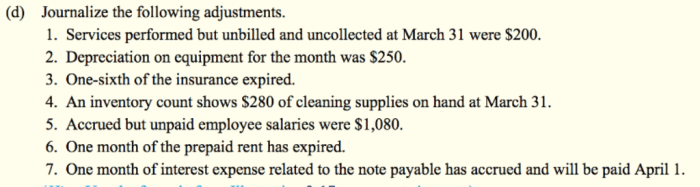

Billing and Revenue Recognition

Billing for SPBU involves issuing invoices to customers for the services rendered. Revenue recognition occurs when the following criteria are met:

- Services have been performed and completed.

- Delivery of services can be verified.

- Payment is probable.

A timeline for billing and revenue recognition varies depending on the industry and company practices.

Best Practices for Managing Unbilled Services

Effective management of SPBU involves:

- Regular billing and invoice generation.

- Monitoring and controlling the backlog of unbilled services.

- Implementing efficient billing processes to minimize errors.

- Utilizing technology to automate tracking and billing.

- Maintaining clear communication with customers regarding unbilled services.

Q&A

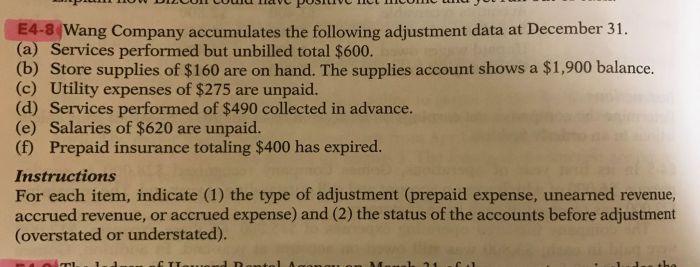

What are the potential risks associated with unbilled services?

Unbilled services can lead to overstatement of revenue, understatement of expenses, and cash flow issues if not managed properly.

How can businesses effectively track unbilled services?

Businesses can use manual tracking systems, spreadsheets, or specialized software to track unbilled services, ensuring accuracy and timely billing.

What are the key criteria for revenue recognition related to unbilled services?

Revenue recognition for unbilled services requires that the services have been performed, the price is determinable, and collection is reasonably assured.