A check drawn by a company for 340 in payment – A check drawn by a company for $340 in payment is a significant document in business transactions, serving as a crucial instrument for financial exchange and record-keeping. This comprehensive analysis delves into the essential elements, implications, and accounting considerations associated with such a check, providing valuable insights for both individuals and organizations.

The check, bearing the essential elements of date, payee, amount, and authorized signature, serves as a legal and binding document, facilitating secure and efficient payment processes. The company’s financial standing and reputation play a pivotal role in establishing the check’s validity and authenticity.

Introduction

A check drawn by a company for 340 in payment is a significant financial document that serves as a legal obligation for the company to pay the specified amount to the payee. Checks play a vital role in business transactions, facilitating secure and convenient exchange of funds.

Check Details

A check typically includes essential elements such as the date, payee, amount, and signature. The date indicates when the check was issued, the payee identifies the recipient of the payment, the amount specifies the monetary value to be paid, and the signature authenticates the authorization of the payment by an authorized company representative.

Company Information: A Check Drawn By A Company For 340 In Payment

The company that issued the check should be clearly identified. Its industry, size, and reputation provide context for assessing the validity of the check. A company with a strong financial standing and a track record of honoring its obligations enhances the credibility of the check.

Payment Purpose

The check should indicate the reason for the payment. This could be for the purchase of goods or services, settlement of an invoice, or reimbursement of expenses. Understanding the purpose of the payment helps in reconciling the transaction with the company’s records.

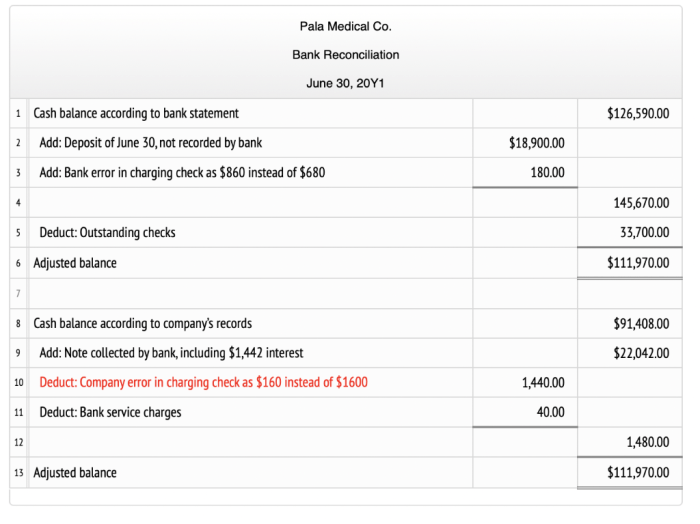

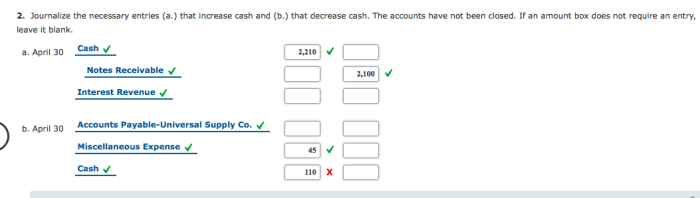

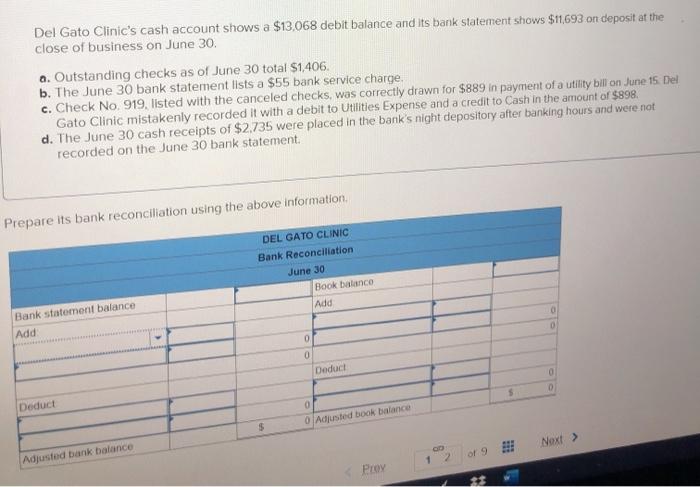

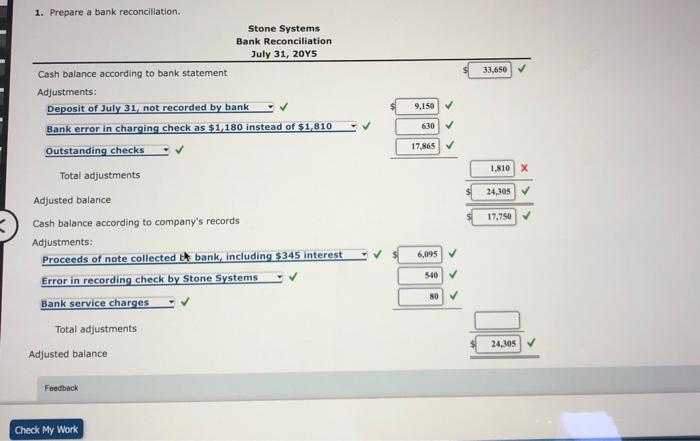

Accounting Considerations

Recording the check payment requires accounting entries to debit the relevant expense or asset account and credit the cash account. The payment impacts the company’s financial statements, affecting the balance sheet (cash balance) and income statement (expenses).

Risk Management

Accepting a check as payment carries certain risks. Verifying the company’s identity, checking for sufficient funds, and considering the company’s financial stability are essential risk mitigation measures. These steps help reduce the likelihood of accepting fraudulent or worthless checks.

User Queries

What are the key elements to consider when examining a check drawn by a company?

The essential elements include the date, payee, amount, and authorized signature, each playing a crucial role in ensuring the check’s validity and authenticity.

How does the company’s financial standing impact the check’s validity?

The company’s financial stability and reputation serve as indicators of the check’s legitimacy, as a financially sound company is more likely to issue genuine checks.

What accounting entries are required to record a check payment?

The payment should be recorded as a debit to the appropriate expense or asset account and a credit to the cash account, reflecting the outflow of funds from the company.